CUSTOMER VALUATION THEORY & FIRM VALUE

Connecting CVT and Firm Value

The success of any marketing firm depends on the incoming and outgoing transfer of value between the firm and its customers. The firm, in seeking to maximize value for itself, must also seek to maximize value for its customers – something that is easier said than done. The finance literature might appear to offer some direction: just as investors follow a roadmap for the valuation of stocks and other financial assets, so too can firms succeed in valuating their customers. Unfortunately, extant finance theories are not applicable to marketing for a variety of reasons. As customers qualify as intangible assets, the process of valuation is far more challenging. Where an investor can identify potentially valuable stocks, build a portfolio, and continually rebalance that portfolio with relative ease, firms are faced with a greater assortment of limitations and complexities. Stock valuation, among other things, tends toward a linear investment-to-earning ratio, greater accuracy with respect to tenure of stock, and greater ease in portfolio imbalance and identification of risk. Customer valuation tends toward the opposite direction, with each of these actions beset with far greater difficulty. A unique theoretical approach is necessary.

This is where Customer Valuation Theory (CVT) comes in. Based on the well-tested propositions that transaction behavior, demographic variables, and economic and environmental factors all significantly influence future customer profitability, CVT stands as an overarching, marketing-specific theory that aims to measure the future value of each customer. This valuation is based on the following key components (Kumar, V., (2018)):

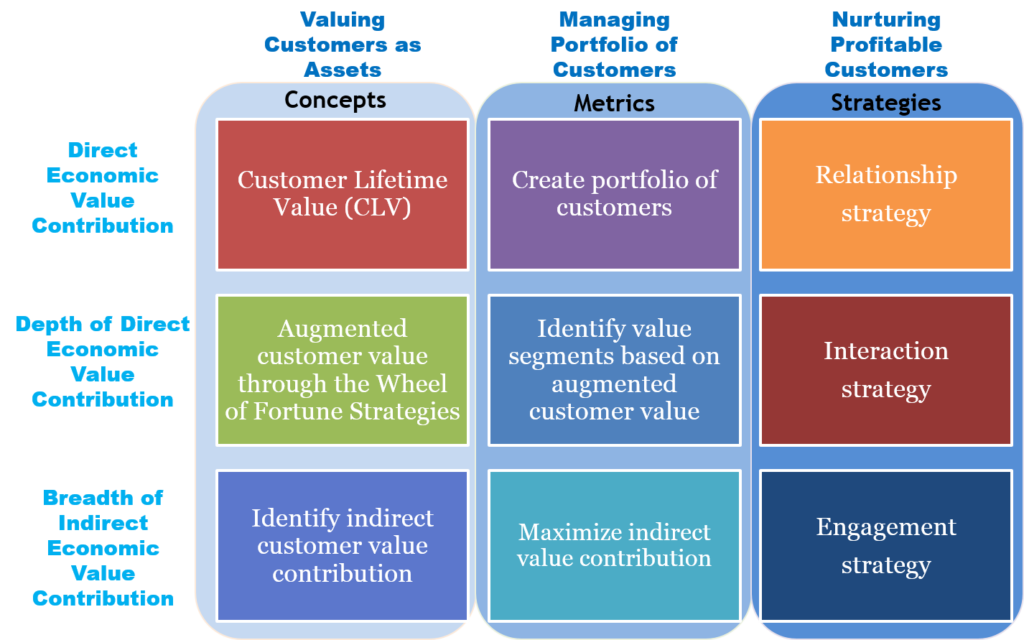

Direct economic value contribution:

Customers contribute direct economic value in the form of profits; this value is therefore to be expressed in monetary terms. A firm that can measure this contribution not only acquires insight into its current marketing performance, but also enhances its decision-making effectiveness in the future.

Depth of direct economic value contribution:

The direct value contribution only refers to the net profit of a given customer’s relationship to the firm. The depth of that contribution refers to the strength of its impact on a firm’s continued financial performance. A customer that purchases from multiple product categories or demonstrates future value potential tends to have a greater depth of contribution.

Breadth of the indirect economic value contribution:

Not all value is contributed directly in terms of profit. Customers can also contribute value indirectly in the form of referrals, online influence, and review/feedback on products and services. Not only do these things drive cash flows of existing or prospective customers, but they also help the firm to make value-enhancing decisions.

CVT allows each of these three components to be optimized across the following organizational functions:

Valuing Customers as Assets (Concepts):

By valuating customers as assets, efforts can be undertaken to enhance firm value. But in order to do this, firms must be able to conceptualize customer value. As the extant finance literature provides no direction, marketing researchers have developed Customer Lifetime Value (CLV) as the bedrock of this conceptualization.

Managing Customer Portfolios (Metrics):

A conceptualization of customer value leads to the development of metrics to accurately ascertain customer value. These metrics are especially relevant in the managing of the customer portfolio, which requires tremendous balance and precision. In implementing CLV metrics, firms can hold onto their customers while also ensuring profitability.

Nurturing Profitable Customers (Strategies):

Having developed concepts and metrics for capturing customer value, firms can then implement specific strategies with the aim of augmenting that value. It is here that a focus on strategies is important

The following 3×3 overview helps to understand how each of the three value components can be optimized conceptually, metrically, and in terms of developing strategies. Click on any of the individual cells for more information.

Customer contribution to firm profitability occurs in two ways: (a) directly – through their purchases, and (b) indirectly – through their non-purchase reactions, i.e., by making referrals to potential customers, by influencing current and potential customers in their network, or by using their own experiences to provide review/feedback for improvements… Learn More

Once a firm has used CLV to determine directly-contributed customer value, it can then use that information to implement value-maximizing strategies. This added impact of customer value corresponds to the depth of the contribution… Learn More

In addition to direct value contributions via purchase, customers can also contribute value to a firm indirectly, through referrals, word-of-mouth, feedback, and other forms of influence… Learn More

The maximization of direct economic value contribution hinges on the construction of a customer portfolio. How is this done? By drawing on the fundamentals of modern portfolio theory – but with some marketing-specific adjustments… Learn More

We know that optimal allocation of resources is the most effective means by which to manage a customer portfolio, such that maximum value potential is realized. In order to identify the most profitable customer segments, a decile analysis must be conducted that factors in both baseline CLV and augmented CLV… Learn More

A customer portfolio will not yield maximum value for the firm if all means by which customers generate value are not taken into account… Learn More

When aiming to maximize the direct contribution of customers to the firm, the CVT proposes that the focus to be on establishing profitable customer relationships that are based on customer transactions… Learn More

The firm-customer relationship is made of constant interactions between the two. To this end, an effective interaction strategy is needed, one that meets the various demands and expectations of the customer base… Learn More

A firm that implements strong customer engagement strategies will foster deep commitment on the part of its customers… Learn More

Benefits

The CVT framework seeks to optimize customer value and, as a result, firm and shareholder value. This encompasses the following benefits:

Benefit to the firms:

A firm that adopts CVT will be able to attract and retain the most valuable customers, nurture the customer-firm relationship, improve its products and services to meet customer expectations, and accurately predict customer responses. This will result in the maximizing of profit at every stage of business activity across all customers.

Benefit to the customers:

CVT prizes the customer as the unit of analysis for every marketing action and reaction. As a result, firms must take the heterogeneity of customers seriously and work to optimize every firm-customer interaction. This, in turn, provides customers with the avenues and incentives to connect and collaborate with both the firm and one another.

Benefit to the environment:

CVT provides firms with the ability to more effectively and efficiently allocate resources so that the right strategies are targeted toward the right customers. This results in a less wasteful expenditure of valuable environmental resources and improved sustainability.

Benefit to the society:

CVT establishes a direct line of communication from firms to customers in terms of what to expect. As a result, firms foster customer loyalty by catering to each customer’s specific needs, ultimately resulting in empowerment on behalf of the customer base.

Benefit to the employees:

CVT, in prioritizing the optimization of customer value, must also prioritize the existence of an engaged workforce that can effectively carry out firm-level strategies. It is difficult to foster customer engagement without similarly engaged employees.

Conclusion

Altogether, CVT provides a strategic roadmap for firms to maximize value through their customers. This results in an abundance of wide-ranging benefits, not only to the firm, but also to the customers, employees, and the environment. CVT uses extant finance theories as a base, but then translates their findings to a marketing context, using CLV and other marketing concepts to develop strategies uniquely geared to the optimization of firm and customer value.

Reference

Kumar, V., (2018) “A Theory of Customer Valuation: Concepts, Metrics, Strategy, and Implementation,” Journal of Marketing, forthcoming.