CUSTOMER VALUATION THEORY & FIRM VALUE

Relationship Strategy

When aiming to maximize the direct contribution of customers to the firm, the CVT proposes that the focus be on establishing profitable customer relationships that are based on customer transactions. However, firms often are unable to determine whether all loyal customers are profitable for the firm.

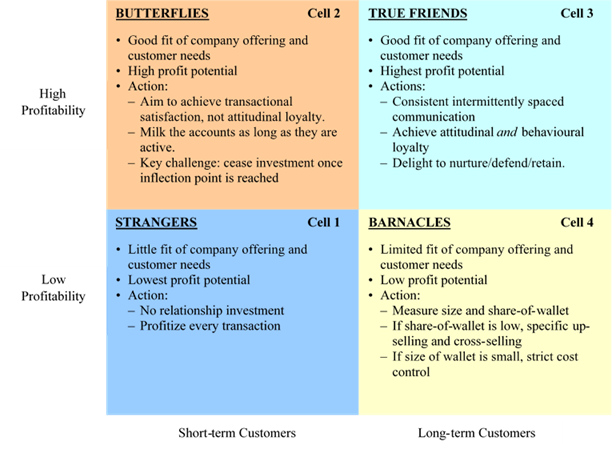

Reinartz and Kumar (2002) analyzed customers based on their repeat purchases and profitability at four companies – a U.S. high-tech corporate service provider, a U.S. mail-order company, a French grocery chain, and a German direct brokerage house – and found that (a) loyal customers do not cost less to serve, (b) loyal customers consistently paid lower prices, and (c) customers who were attitudinally and behaviorally loyal were more likely to be active word-of-mouth marketers than those who were only behaviorally loyal. In effect, the study found that while there may be long- standing customers who are only marginally profitable, there also may be short-term customers who are highly profitable. The identification of the distinct customer types led to the development of the following 2X2 matrix:

Managing Loyalty and Profitability Simultaneously

The 4 cells in the above figure can be described as follows:

High repeat purchases and high profitability.

Referred to as “True Friends”, these customers buy steadily and regularly (not too intensively) over time. They are generally satisfied with the firm and are usually comfortable engaging with the firm’s processes. Managerially, firms should take care in building relationships with these customers, since they present the firm with the highest potential to bring long-term profitability.

Low repeat purchases and high profitability.

Referred to as “Butterflies”, these customers do not repeat purchase often, tend to buy a lot in a short time period and then move on to other firms, and avoid building a long-term relationship with any single firm. Managerially, firms should enjoy their profits while they last and stop investing in these customers when they turn to competition.

High repeat purchases and low profitability.

Referred to as “Barnacles”, these customers, if managed unwisely, could drain the company’s resources. Firms must evaluate their size and share-of-wallet. If the share-of-wallet is found to be low, firms can up-sell and cross-sell to them to make them profitable. However, if the size of wallet is small, then, strict cost control measures have to be taken in order to prevent losses for the firm.

Low repeat purchases and low profitability.

Referred to as “Strangers”, not only are these customers a poor fit to the company, but offer very little profit potential to the firm. It is critical to identify these customers early on. Managerially, firms have to avoid any investment towards building a relationship with these customers, and must ensure profits from every transaction.

Once this strategy is implemented managers are able to: (a) build and enhance behavioral loyalty by focusing on each customer’s purchase behavior and their respective contributions to firm profit, (b) cultivate attitudinal loyalty by studying customers’ attitudes towards the firm, (c) link loyalty to profitability by using the CLV metric, and (d) create a successful loyalty program. All these would ultimately lead the managers to identify those customers who provide the most value to the company and prioritize the marketing efforts accordingly.

Reference

Reinartz, Werner J., and V. Kumar (2002), “The Mismanagement of Customer Loyalty,” Harvard Business Review, 80 (7), 86-94.