CUSTOMER VALUATION THEORY & FIRM VALUE

Customer Lifetime Value

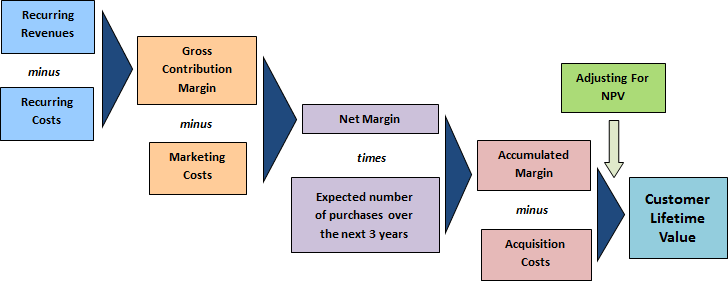

In contrast to the traditional metrics, Customer Lifetime Value (CLV) is a powerful metric that accommodates the dynamics in customer purchase activities. Put simply, CLV is a measure of the future worth of a customer to the firm. As a result, CLV enables firms to treat individual customers differentially, and exclusively from each other based on their contributions to the company. Formally, CLV can be defined as follows:

“The sum of cumulated cash flows – discounted using the weighted average cost of capital (WACC) – of a customer over his or her entire lifetime with the company.”

The CLV metric can be calculated at an individual or an aggregate level and as a result, provide managers with valuable information about the evolution of a client’s Lifetime Value (LTV) over time. In its general form, CLV can be expressed as (Kumar, V., and Werner Reinartz (2016), “Creating Enduring Customer Value,” Journal of Marketing, Vol. 80 (Nov.), 36-68.):

CLV Measurement Approach

It is important to note that CLV is measured by predicting the purchase pattern (frequency of purchases) over a reasonable time period. The determination of the time period is critical, as it varies across industries. Although a “true” CLV measure implies measuring the customer’s value over his or her lifetime, for most applications it is three years. The reason for the time period being three years is due to following reasons:

(1) Since future cash flows are heavily discounted, a significant portion of profit can be accounted for in the first three years. Further, the contribution in the following years are very small.

(2) The predictive accuracy of the models declines over a longer timeframe.

(3) Changes in customer needs and life cycle are likely to change significantly beyond a 3-year window.

(4) Product offerings change in response to technological advancements and customer needs.

CLV predictions are updated based on a rolling-time horizon to accommodate changes in other environmental factors. However, specific industry trends do lead to some exceptions for this 3-year window. For instance, automakers can expect the customers to make a purchase every 4 to 6 years. In such a case, a longer time window is recommended to accommodate at least a couple of purchases or use purchase intention measures to forecast future value. Similarly, computer manufacturers can expect customers to make a purchase every 1 to 2 years. In this case, a 4 to 5-year window is recommended to account for at least 2-3 purchases.

Reference

Kumar, V. (2008), Managing Customers for Profits, Upper Saddle River, NJ: Wharton School Publishing.

Kumar, V., and Werner Reinartz (2016), “Creating Enduring Customer Value,” Journal of Marketing, Vol. 80 (Nov.), 36-68.