BUILDING ON THE PRINCIPLES OF CLV

Business Reference Value

In a business-to-business (B2B) context, organizations take on the role that customers do in the business-to-customer (B2C) environment. Selling to a business is generally complicated – compared to a single customer, the prospective business is not an autonomous entity, and it usually relegates purchasing decisions to teams of employees, who weigh a variety of factors before closing a deal (Kumar, V. (2013)). The key drivers influencing this decision can be subdivided into firm-initiated efforts, competitor-initiated efforts, client-initiated efforts, and prospect characteristics. Business Reference Value (BRV) captures the degree to which client-initiated efforts, in the form of business references, can provide value to the selling firm (Kumar, Petersen, and Leone (2013)).

The drivers of BRV include

(1) Client Firm Size:

With respect to Client Firm Size, the larger and therefore more prominent a firm, the more advantageous it will be as a reference.

2) Length of Client Relationship:

Insofar as Length of Client Relationship implies a certain level of embeddedness within the selling firm, the longer the client relationship, the more likely the client will be selected as a reference (however, it is possible to be over-embedded; selling firms will generally not select clients whose length of relationship exceeds a certain threshold value).

(3) Reference Media Format:

Reference Media Format refers to the way that the reference is communicated. Generally, richer modes of communication are more effective.

(4) Reference Congruency:

Reference Congruency refers to the alignment between the referencing client and the prospective client. The greater the congruency on the part of the client firm, the greater its BRV.

The computation of BRV involves measuring the following three components: the degree to which the prospect client is influenced by the client references in making its purchase; the degree to which the prospect client is influenced by a given individual reference in making its purchase; and the prospect’s profitability after making its purchase. After calculating BRV for a pool of client firms, they can then be rank-ordered from highest to lowest BRV and then segmented accordingly.

Similar to the case of Customer Referral Value, the clients that have high CLV scores are not the same as those that provide the most valuable references. Therefore, it is important for the seller firm to manage their client firms based on their CLV and their BRV scores.

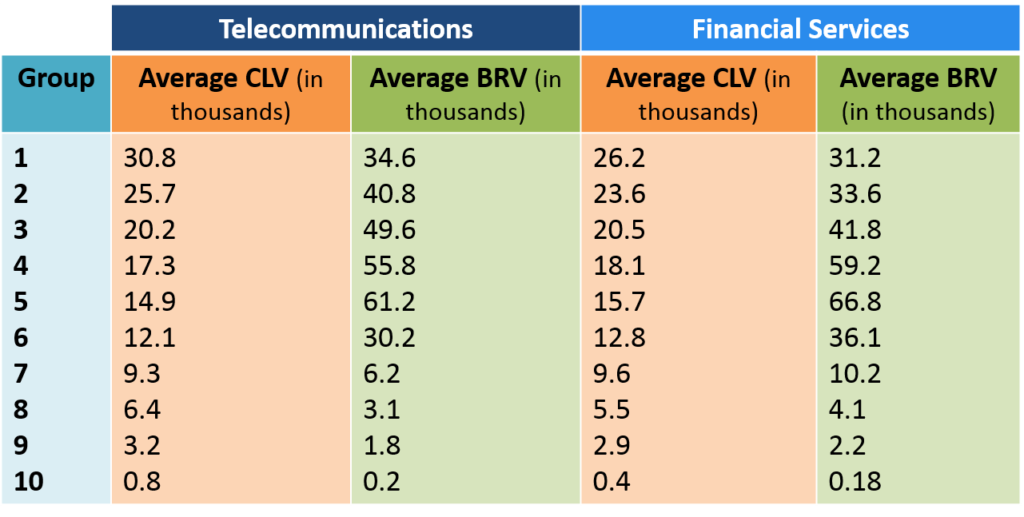

In a study involving a telecommunications firm and a financial services firm, the client firms were rank-ordered by their CLV scores (over a three-year period) and then divided into ten groups for which the average CLV and BRV for each group was computed, as shown below

Client Firm Analysis for BRV and CLV

From the above table, it is clear that the clients with the highest BRV fall into the third, fourth, and fifth groups on CLV with the fifth group having the highest BRV in both firms. Further, the study established that clients with the highest CLV (Groups 1 and 2) have higher BRV compared to clients with the lowest CLV (Groups 7-10). The contributing factor for this relationship is due to client firm size. Effectively, the bigger the client firm, the higher the BRV of the firm.

However, medium CLV clients (Groups 3, 4, and 5) have the highest BRV due to the length of the client relationship and the congruency effect. As such, a medium-length client relationship leads to higher BRV. In terms of congruency, it was found that many of the prospects being targeted for acquisition had the most in common with the customers in the medium CLV group – therefore, the higher the congruency, the higher the BRV. Based on this finding, it could be more profitable for firms to get their medium to high-value clients (Groups 1-7) to provide references than to focus on cross- and/or up-selling to those clients.

References

Kumar, V., J Andrew Petersen, and Robert P Leone (2013), “Defining, measuring, and managing business reference value,” Journal of Marketing, 77 (1), 68-86.

Kumar, V. (2013), Profitable Customer Engagement. Thousand Oaks, CA: Sage Publications Inc.